Since 2015, Vietnam Holding Limited (VNH) has been the first investment fund in Vietnam to attempt to measure the carbon footprint for their investment portfolio with VNEEC as the consultant to conduct the independent assessments of the VNH portfolio’s carbon footprint. In 2022, VNH became even more ambitious by requesting VNEEC to implement a comprehensive climate risk assessment service that includes both transition and physical risks of climate change on the enterprises in the VNH portfolio.

This assessment was conducted in light of drastic changes in the national policies towards controlling and mitigating GHG emissions in Vietnam as well as the strong international incentives on financial and climate risk disclosure. Notably, Circular 96/2020/TT-BTC on Guiding the disclosure of Information on the Securities Market that required the public company to disclose their total direct and indirect emissions in their annual report from 2021 onwards. In January 2022, Decision No. 01/2022/QD-TTg of the Prime Minister was issued, defining the List of Sectors and Establishment Required to Perform GHG Inventory. Regarding international incentives, the Task Force on Climate-related Financial Disclosures (TFCD) recommends the evaluation and disclosure of climate-related risks, while Vietnam has been ranked as one of the top vulnerable countries to climate change.

In this context, the continuing effort to conduct a regular assessment of the portfolio carbon footprint and pioneering climate risk assessment of VNH provides a good demonstration case as a socially responsible investor in Vietnam.

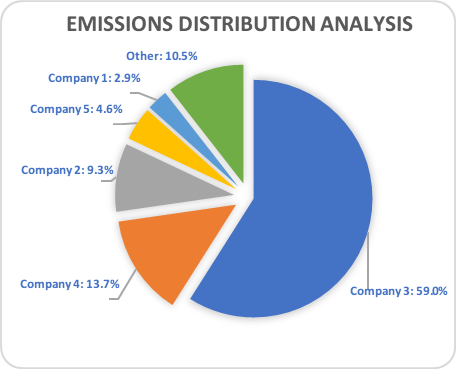

The portfolio’s carbon footprint was calculated using both the investee activity data (bottom-up) and national and sectoral data (top-down) approaches, following the principles of the GHG Protocol standards. The result includes the total emissions from all scopes (tCO2e) and carbon footprint (tCO2e/$M invested) of the portfolio, data disclosures status of the investee, and a detailed analysis of the emissions attribution of each investee and each sector. VNH’s carbon footprint is also compared with the market benchmark, which is similar-sized investments in the VNAllShare index.

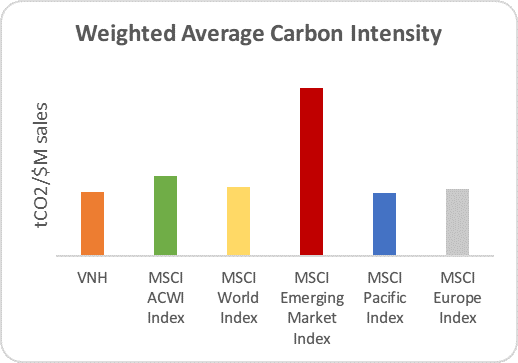

The climate risks assessment was conducted according to the TCFD Guidelines, incorporating both transition and physical risk. In terms of transition risks, both qualitative and quantitative approaches were used. Recommended metrics such as the Weighted Average Carbon Intensity (WACI), Implied Temperature Rise, and the potential financial loss due to carbon offset by policy risks was calculated and compared to global indexes. The Transition risk exposure heat map was used for a qualitative assessment of the investment in Vietnam.

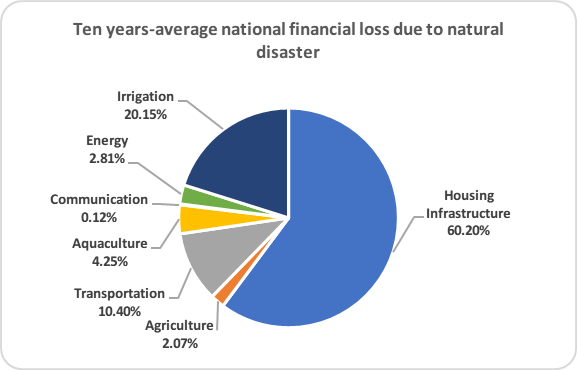

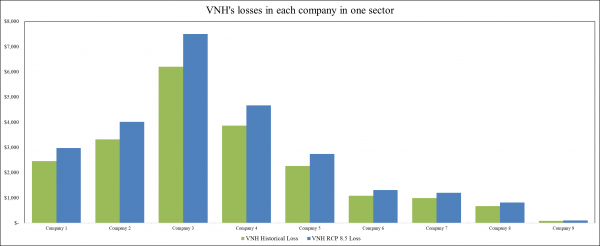

The approach to estimate the physical risk is tailor-made for Vietnam that took into account the most frequent natural disasters (storms, floods, droughts), vulnerability, and domestic cost norms and using the historical statistical data collected from and synthesized by the Viet Nam Disaster Management Authority. The calculation also examined the future climate scenario (RCP 4.5 and RCP 8.5) introduced in the IPPC 5th Assessment Report in order to estimate the possible future financial impacts on VNH’s portfolio in 2050. The results include the potential financial loss of each investee and VNH’s total loss due to its investment, analysis of the vulnerability of each investee, and each sector to each type of natural disaster.

Overall, this assessment report provides in-depth insights to support VNH in making investment decisions, strategies that include suitable GHG emissions reduction targets and visionary plans to reach these targets as well as in disclosing relevant climate and risk exposure data.

VNEEC is proudly being one of the first consultancy firms to offer comprehensive carbon footprint and climate risks assessment services in Viet Nam. The service is able to be extended and tailored to different sectors and for all types of organizations, businesses, and investment portfolios with high certainty results since it is not only able to specify each business but also reflects the nature of the sectors and national context of Vietnam.

* All figures are resulted of VNEEC analysis*

Duong Anh Dung

4,234 views, 6

Tags:

Bài viết liên quan